March 17, 2022

Written By: Andrew Hallam

It’s currently one of the talked-about quotes online: “Fixed-income investors worldwide – whether pension funds, insurance companies or retirees – face a bleak future.” Warren Buffett wrote this in his 2020 letter to Berkshire Hathaway shareholders. And it might have you wondering whether you should own bond index funds at all. Warren Buffett, however, wasn’t referring to short-term or broad bond market index funds. Nor was he sensitive to the behavioral benefits of maintaining and rebalancing a diversified portfolio of bond market index funds for mortals.

I began investing in 1989 when I was nineteen. Three years later, Joe Dominguez and Vicki Robin published Your Money or Your Life. It was one of the most popular personal finance books of the era. It prioritized embracing a minimalist lifestyle: a focus on time and life, instead of material things. It also recommended people put 100 percent of their investments in bonds.

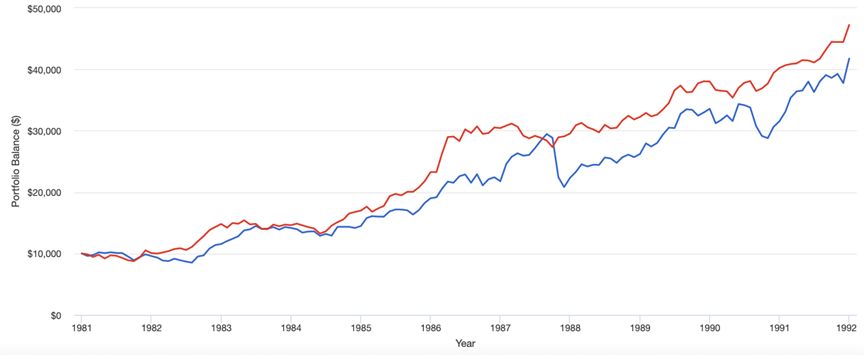

That wasn’t good advice. But we can see why the authors believed it. When that book was published in 1992, bond interest yields were high. According to portfoliovisualizer.com, a $10,000 investment in long-term US Treasury bonds in 1981 would have grown to $47,242 eleven years later. A $10,000 investment in a US stock market index would have earned less money, with more volatility.

Long-term US Treasury Bonds vs. U.S. Stocks

1981-1992

But few people recommend 100 percent bonds today. After all, they pay barrel-scraping interest. And anyone caught with a 10-year bond will almost certainly lose to inflation. In January 2022 U.S. inflation (measurement in the rise of living costs) was 7.2 percent higher than it was, compared to January 2021. As interest rates rise, bond prices drop. That one-two punch is why one of my readers asked me whether she should diversify with stock index funds and cash in a savings account, instead of stocks and a bond market index. Several other readers asked me if they should switch from a diversified portfolio of stocks and bond market indexes to 100 percent stocks.

Here are four reasons I said no on both accounts.

- Savings accounts always lose to inflation

- The behavioral benefits of bond index funds are real

- A bond index’s internal turnover has added benefits

- Bond price drops (much like stock price drops) can benefit investors maintaining a consistent allocation.

Savings Accounts Always Lose To Inflation

Savings accounts lose every month to inflation, and CDs are designed to match inflation. But neither will ever earn a real (after inflation) return, as I explain here.

The Behavioral Benefits of Bond Index Funds Are Real

Most people don’t know how they would respond if they were hit by a car and forced into a wheelchair. Research suggests we’re poor predictors of how we will feel when adversity hits. Many of us, for example, believe we could handle a portfolio invested 100 percent in stocks. But when faced with the volatility of such a portfolio, many of us sabotage our rides. We begin to speculate. We might hold back on deposits after stocks fall. We might sell low. We might stop investing, waiting for “a better time.” But diversified portfolios that include stock and bond market index funds can help. Such portfolios don’t fall as hard when stocks crash. That often helps investors stay the course. It’s important to remember that how a portfolio allocation performs isn’t as important as how a person performs with a specific allocation.

A Bond Index’s Internal Turnover Has Added Benefits

Bond market indexes often comprise thousands of bonds with different maturity dates. For example, Vanguard’s Total Bond Market fund includes more than 10,000 bonds. When a one-year bond within that index matures, the fund company uses the proceeds to purchase another one-year bond. When a three-year bond expires, it purchases another three-year bond. One of the reasons bond interest rates were high when Joe Dominguez and Vicki Robin published Your Money or Your Life is because inflation was high. Few people, for example, would buy a 5-year bond yielding 1 percent per year if inflation were 7 percent. As inflation rises, bond prices drop, pushing interest yields up. To compete, when new bonds are issued, their interest rates reflect that new competitive rate.

This doesn’t mean your bond market index will make money every year. It can drop in value, perhaps for a couple of years in a row as bond prices dip. But bond index funds don’t fall as far as stocks when markets crash. Sometimes, they even rise when stocks fall.

Bond Price Drops Can Benefit Investors That Maintain A Consistent Allocation

It’s well known (although behaviorally tough to embrace) that when stock indexes drop, we’re able to buy more units with the same amount of money. It’s like a supermarket sale. But we often don’t consider the same reality with a bond market index. Yet we should, because short-term or broad bond market indexes aren’t the same as an individual bond. They have an internal turnover that replaces maturing bonds with new bonds. And when inflation rises, the drop in bond prices pushes their interest yields up.

The process of maintaining a consistent allocation between stock and bond market index funds requires investors to rebalance their portfolios (you could do this once a year) by selling portions of their winning index to put those proceeds into their losing index. In some cases, the “winning index” might simply be the one that loses less. If the account is relatively small, investors could “rebalance” just by adding fresh money every month to the underperforming index.

It’s important, however, never to speculate. Don’t abandon a diversified portfolio of stock and bond market indexes because of forecasts, current interest yields, or a price drop. Don’t abandon bonds for cash. You don’t know what bond prices or yields will be next year or five years from now. Nobody does. And with bond market indexes, you won’t be stuck with current prices or current yields.

Unfortunately, every week of every year, a headline, forecast, or what’s “currently happening in the markets” will try to move you off course. In this long-term game, patience and consistency will be your best friend. Acting on speculation will almost always hurt you most.

Andrew Hallam is a Digital Nomad. He’s the author of the bestseller Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

This article and or podcast contains the opinions of the author but not necessarily the opinions of AssetBuilder Inc. The opinion of the author is subject to change without notice. All materials presented are compiled from sources believed to be reliable and current, but accuracy cannot be guaranteed. This article is distributed for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product, or service.

Performance data shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown.

AssetBuilder Inc. is an investment advisor registered with the Securities and Exchange Commission. Consider the investment objectives, risks, and expenses carefully before investing.