August 20, 2020

Written By: Andrew Hallam

It was 2009. I was living in Singapore where plenty of the country’s expats enjoyed tennis, dining, working out and social activities at the long-standing American Club. First established in 1948, its doors have been open for 72 years. As with any well-run establishment, they kept money in their coffers to cover future costs. But unlike plenty of other clubs, they invested much of that money like a college endowment fund.

However, when stocks crashed in 2008/2009, committee members expressed concern as the club’s account shrank. One vocal member said they should put everything in gold. I cringed at the time.

The ancient Egyptians were among the first to covet gold, in roughly 3,100 B.C. Since then, it has been used in dentistry, electronics and…most prolifically, jewelry. It’s the go-to material for almost everyone’s wedding band. As an investment, some people see it as solid as a rock, till death do us part. Perhaps that’s why it’s so darn romantic. But gold isn’t a stable spouse. In fact, it’s more like an angry bird that just jumps up and down.

Year-to-year, it’s more volatile than stocks. For example, over the past 48 calendar years, gold’s price dropped 18 times. Over that same time period, U.S. stocks dropped 11 times.

And when gold fell, it often crashed hard. It plunged 24.8 percent in 1975. In 1981, it cratered 32.6 percent. It dropped 16.31 percent in 1983, before tumbling a further 19.38 percent in 1984. In 1988, gold dropped 15.26 percent. In 1997, it tumbled 21.41 percent, and in 2013 it plunged 28.37 percent.

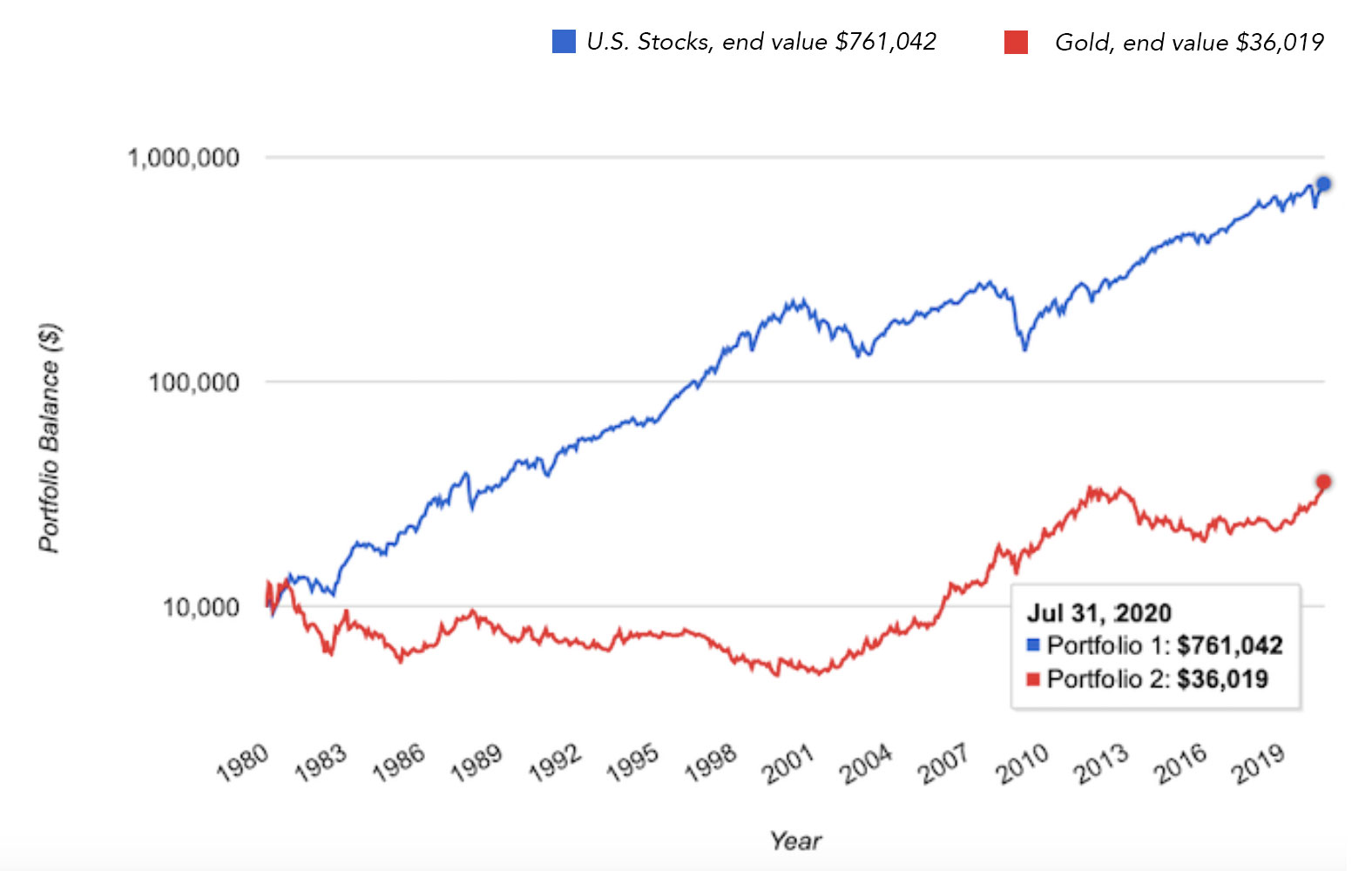

Long-term, gold looks even worse. According to Jeremy Siegel’s book, Stocks for the Long Run and updated research from Morningstar.com, one dollar invested in gold in 1801, it would have grown to just $101 by August 7, 2020. In contrast, a dollar invested in U.S. stocks would have grown to a whopping $28.42 million.

Unfortunately, people often look to gold exactly when they shouldn’t. That’s happening today. It also happened to the American Club’s association members in 2009. I don’t know if they poured everything into gold when the media’s experts called for Financial Armageddon. I sincerely hope they didn’t.

Since 2009, U.S. stocks gained more than twice as much as gold. And stocks did so with fewer calendar year declines.

When gold looks like a savior, it usually disappoints. For example, stocks fell hard in 1973 and 1974. President Nixon was mired in the Watergate scandal. We feared a nuclear war with Russia and inflation hit double digits. These were uncertain times. Plenty of people rushed into gold like lemmings for a cliff.

Then gold plunged nearly 30 percent over the next two years. By comparison, U.S. stocks soared 68.44 percent. Few people expected that.

Gold was also popular in 1980. With the U.S. in recession, Gold Bugs thought this made a lot of sense. Unfortunately, running for the golden bunker didn’t end well. If someone invested $100 in gold in 1980, three years later, it would have plunged to $46. Meanwhile, U.S. stocks gained 53.79 percent.

This year, gold is popular once again, gaining about 33 percent to August 7, 2020. But according to Duke University Business professor Campbell R. Harvey and his fellow researchers, Claude B. Erb and Tadas E. Viskanta, gold still hasn’t beaten inflation since hitting peaks in January 1980 and August 2011.

That doesn’t mean it won’t. Gold could continue to rise for another year or two. But it could also plunge tomorrow. Unfortunately, too many investors believe they can time its moves. They dream of jumping in before it rises and jumping out before it falls. Others will claim, as people always do, “This time will be different.” Those are dangerous words, however delusional or romantic.

Andrew Hallam is a Digital Nomad. He’s the author of the bestseller Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

This article and or podcast contains the opinions of the author but not necessarily the opinions of AssetBuilder Inc. The opinion of the author is subject to change without notice. All materials presented are compiled from sources believed to be reliable and current, but accuracy cannot be guaranteed. This article is distributed for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product, or service.

Performance data shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown.

AssetBuilder Inc. is an investment advisor registered with the Securities and Exchange Commission. Consider the investment objectives, risks, and expenses carefully before investing.